Originally published on PLANADVISER.com | By Lee Barney | July 27, 2017

Some industry experts believe managed account performance should not be benchmarked against an index but instead against an investor’s unique individual goals.

A critical question for advisers to ask when suggesting managed accounts to a plan sponsor client is whether it is possible to benchmark a managed account’s performance in a consistent way across the plan population.

Since each managed account will be customized for an individual participant, taking into consideration their risk tolerance, account balance, compensation, deferral rate and outside assets, the process of benchmarking managed accounts can get quite complicated.

As Kendrick Wakeman, president of FinMason, an investment analytics firm in Boston, puts it, “A managed account is designed to take into account a participant’s specific tolerance for risk and their financial situation to determine how much investment risk they should have in their portfolio.” Given the wide range in individuals’ financial circumstances across any employee population, it’s reasonable to assume there will be some diversity in their managed account construction.

Jason Grantz, director of institutional retirement consulting at Unified Trust Company in Highland Park, New Jersey, says it is important for managed account providers to understand what sponsors would like to see their plans accomplish. “For instance, if the goal is to replace 70% of income in retirement and they are starting out at a 40% level, measuring how that improves is a good way to benchmark the progress of a managed account.”

Since a managed account is really a service rather than a product, Grantz says, it really does not make sense to benchmark the managed account’s performance against an index. “If you are invested in a large-cap core fund, you do want to benchmark it against a large-cap core index to see if it is hugging the index,” Grantz says. “But a managed account is a customized service, and it should be measured against the participant’s stated objective.”

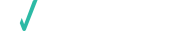

Anton Honikman, CEO of managed account provider MyVest in San Francisco, agrees: “The traditional concept of benchmarking a mutual fund is inappropriate for a managed account due to its customization. If you are personalizing an investment solution, you are doing so to meet the plan participant’s goals, be they to replace a certain percentage of their final income or to have a certain amount of money saved.”

![Advisory Firms Work to Scale Rep-as-PM Programs [FundFire]](https://myvest.com/wp-content/uploads/FundFire-Interview.jpg)

![Why Direct Indexing Isn’t Yet Taking Over the Investing Universe [Financial Advisor]](https://myvest.com/wp-content/uploads/FA_magazine-e1678729635277.png)