Following is an excerpt from Vasyl Soloshchuk’s profile of MyVest for WealthTech Club, in which he covered our product offering, software development process, data security, and much more.

We continue our deep dive into innovative WealthTech companies that are disrupting the landscape and bringing more innovation to the market. This time we spoke with the team at MyVest, a FinTech trailblazer that is utilizing the power of technology and applying industry lessons learnt to create its daring offerings.

MyVest is an international team of like-minded people who are passionate about bringing technology to serve the evolving needs of larger communities and putting digital technology to use to generate more wealth for its end users.

MyVest’s offering: What makes it stand out?

“Most of the enterprise wealth management solutions have focused on what I regard as the ‘orthodoxy’ of our industry.”

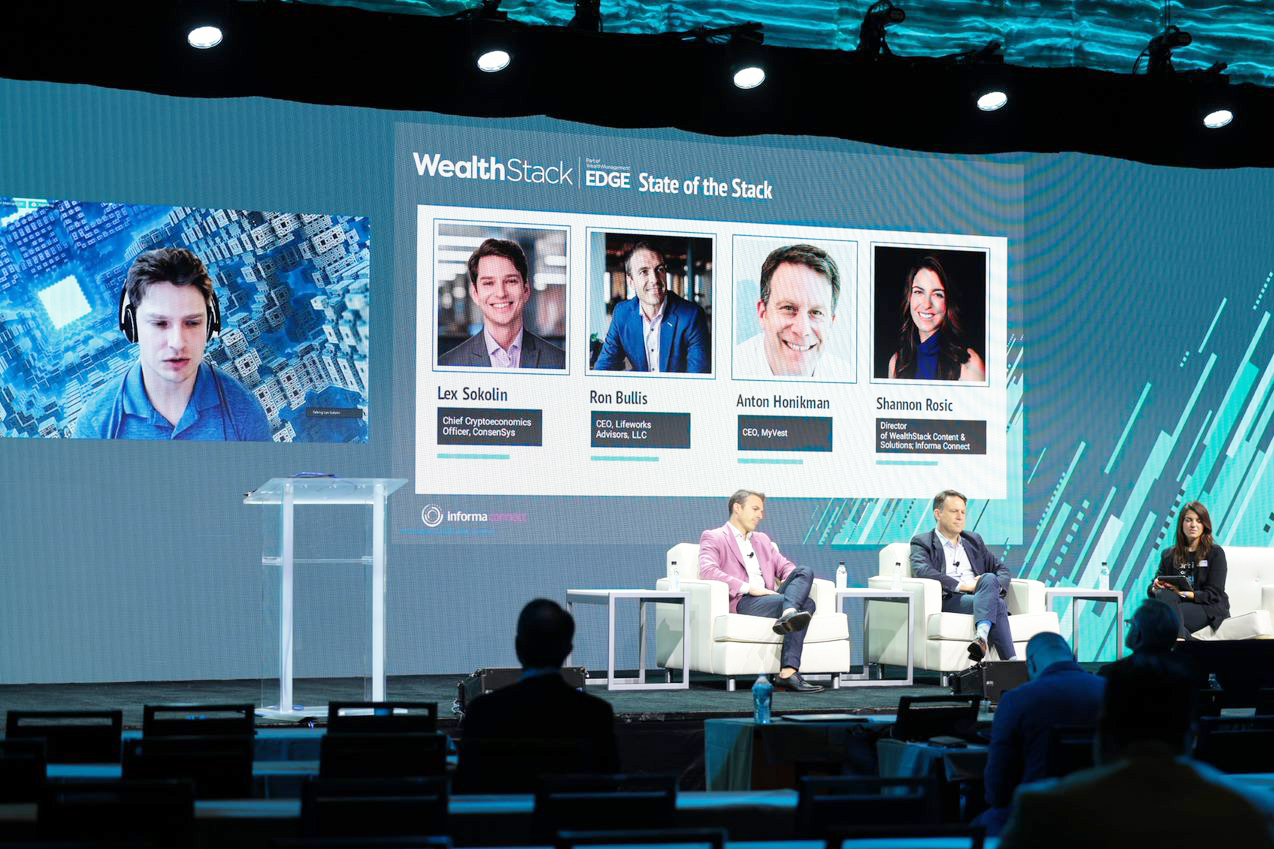

– Anton Honikman, CEO

Anton Honikman states that the classic industry approach to wealth management is product-centric, and is generally focused on selecting third-party managers and making them available in a single account to investors. This is where MyVest has something different to offer:

- The investment journey begins with the customer in mind. In other words, MyVest adds personalization to portfolios and “tax manages” them throughout its enterprise wealth management platform.

- The ultimate focus of MyVest is the investor, for whom the tech company enables advisors to build customized portfolios that are holistic, personalized, and tax-managed. Only after an advisor has made the strategic portfolio decisions does the technological aspect come into play through implementation across their entire book of business to help firms scale their offerings.

- To enable holistic portfolios, MyVest engineered a unique household-based data model that enables multiple accounts across a household to be coordinated into an overarching investment strategy aligned with one or more goals.

- For tax management, they offer more than just simple rebalancing when their system optimizes the balance between risk, personalizations, and tax impact. Tax management includes proactively harvesting losses, smart deferral of gains, facilitating best-tax lot relief, and optimizing asset location, providing advisors an easy way to manage the inherent trade-off between improving tracking error and reducing taxes.

“We generate tax alpha in multiple different ways. Proactive tax loss harvesting is one of them, intelligent gains deferral, asset location, best tax lot relief, plus more.” – Anton Honikman

. . .

Read the full profile on the WealthTech Club blog.

![Advisory Firms Work to Scale Rep-as-PM Programs [FundFire]](https://www.myvest.com/wp-content/uploads/FundFire-Interview.jpg)

![Why Direct Indexing Isn’t Yet Taking Over the Investing Universe [Financial Advisor]](https://www.myvest.com/wp-content/uploads/FA_magazine-e1678729635277.png)